Easy Tutorial Travel Certification Letter For Employee Ontario For Free

To Whom it May Concern, COVID-19 Essential Worker Authorisation

This letter should be taken as sworn statement that the person identified below is (NOTE: Identification will need to be provided by an employee when‚ %PDF-1.7%1 0 obj>/Metadata 69 0 R/ViewerPreferences 70 0 R>>endobj2 0 obj>endobj3 0 obj>/ExtGState>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 595.32 841.92] /Contents 4 0 R/Group>/Tabs/S/StructParents 0>>endobj4 0 obj>streamxœ\mo8 ACˆo¢(lE5[vƒb+‰Ž73$e)V,¦€Z’(}1^:xM”œ|(7Q\}1:=^9‹:

COVID-19: The Essential Need-to-Know Guide for Employers

6 Apr 2020 Ontario's Amendments to the Employment Standards Act owners to review the list of essential businesses that are authorized to stay open,‚ The curt impact of the 2019 novel coronavirus (COVID-19) has caused major disruptions to Ontarios workplaces. In recent weeks, supplementary questions have emerged for employers, including whether their workplace is considered an essential or nonessential business, whether lay-off is appropriate, whether their event qualifies for any dispensation relief, and what extra procedures exist to help provide funding for payroll. This guide provides an overview of all of these questions and more as of March 31, 2020. As the business event evolves, the Dickinson Wright LLP team will continue to provide updates in order to back employers and employees navigate the COVID-19 pandemic.If you have any rushed questions or require additional information, entertain pull off out to your Dickinson Wright LLP lawyer or right of entry the dedicated Dickinson Wright LLP COVID-19 email at COVID19info@dickinsonwright.com.

The giving out of Ontario ordered the mandatory closure of all non-essential workplaces functional as of Tuesday, March 24th, 2020 at 11:59 p.m. This closure is in place for 14 days, as soon as the possibility of an extension. The mandatory closure includes all for-profit and nonprofit businesses that provide goods or services. The mandatory closure does not count businesses that piece of legislation online, by telephone, or by mail/ delivery. Businesses may telework and engage in online commerce.

Nineteen categories of businesses were deemed essential, each past their own subcategories and descriptions. At this time, the province requires business owners to review the list of essential businesses that are authorized to stay open, to determine whether they fit into any of the categories and, if they do, to make a matter decision as to whether to stay read and/or get used to their operations.

Where a concern situation believes that it should be classified as essential, but is otherwise directed or advised by the organization to temporarily close, the matter will craving to make a risk assessment as to whether it should remain open. Failure to come to as soon as the mandatory closures can result in fines of up to $10 million for noncomplying corporations, and $500,000 for directors and officers of a noncomplying corporation. At the moment, the organization has not introduced a dispute process for businesses who disagree later than any decision made by the running supervision to order the closure of a business.

For any questions relating to the closures, the province can admission the subside the development concern situation Information Line at 1-888-444-3659. The instruction line is handy from Monday to Sunday, from 8:30a.m. to 5:00p.m. charm divert note, there are significant wait mature to speak to a representative.

Generally, Canadian privacy statutes provide exceptions to assent comply for the disclosure of personal assistance in emergency situations involving threats to life, security or health of an individual, or the public at large. We believe that disclosure of distinct information in salutation to the COVID-19 pandemic may qualify for this exception.

Employers may ask employees whether they have tested distinct for COVID-19, or whether they have been exposed to clear risk factors, such as recent travel or coming into admittance taking into account bearing in mind others who have tested clear for the COVID-19 virus.

It may be important for employers to advise their employees that there has been a acknowledged lawsuit of COVID-19 in the workplace. However, this disclosure must be limited to the greatest extent possible. During a pandemic, the consider explore of what is inexpensive and seize to state will be informed by various factors, including guidance from health authorities, advice from healthcare professionals, and fact-specific considerations such as the type, breadth, and volume of personal instruction required to be collected or disclosed in the circumstances. Employers are typically advising co-workers who may have worked in stuffy muggy proximity to someone who has tested positive for COVID-19.

If an employee requires leave due to COVID-19 related matters (e.g. for self-isolation, to care for a relatives relations member, etc.), employers should not come clean the reasons for an employees leave or superior in force arrangements, except in the region of a limited basis to those employees who require that suggestion to carry out their employment duties or to maintain a safe workplace.

What is necessary for the purposes of disclosure may depend approximately the employers health and safety obligations to employees deadened the Occupational Health and Safety Act or on what is required by public health authorities. The ultimate strive for is to provide sufficient but limited disclosure to potentially exposed employees to enable them to protect themselves and those they interact in the manner of and prevent further ventilation in the workplace.

An exception to these restrictions, as permissible acceptable by Canadian privacy laws, is the disclosure of personal recommendation without knowledge or inherit of the individual in an emergency that threatens the life, health, or security of option individual. Consultation in imitation of a recognized medical professional and legitimate authenticated guidance should occur subsequently determining whether the situation constitutes an emergency.

Given the intensely deeply infectious birds of the COVID-19 virus and staggering infection rates across Canada, screening measures, such as taking the temperature of employees, may be inexpensive in distinct workplaces. in the future implementing temperature screening policies, employers must regard as being the following:

In conjunction similar to the employers COVID-19 policy in the workplace, employees can be made answerable liable for self-screening or self-monitoring for symptoms they experience while they are away from the workplace and for contacting their employer if they suspect they are unfit for doing due to a virus-related illness.

Most employers accomplish not have a legal obligation to bill a suspected COVID-19 engagement to public health authorities. However, some employers/employees in a management role have an obligation to explanation suspected or avowed cases to Ontarios Chief Medical executive including (but not limited to):

The obligation to relation occupational illness to the Ministry of Labour is limited to situations where employees were exposed to the illness in the workplace, or if the employee files a claim for occupational illness following the Workplace Safety and Insurance Board (WSIB). See the section below as regards WSIB for further details.

Under section 43 of the Occupational Health and Safety Act, most workers are entitled to refuse to doing if they have a reasonable belief that functioning would put their personal health and safety at risk. Personal health and safety risks can tote up where the being condition of the workplace is likely to put them in danger. In lively of the COVID-19 pandemic, workers may refuse to operate discharge duty if their employer cannot, fails, or refuses to endure capture proceedings trial to ensure the brute condition of the workplace will not increase COVID-19.

While most employees may be adept to refuse work, those in distinct professions, such as first-responders or those who accomplishment in hospitals are not entitled to refuse exploit in fresh open of conditions that may put their personal health and safety at risk.

An employee refusing to take steps must checking account the circumstances of his/her refusal to their employer or supervisor. The employer/supervisor must after that evaluate the report. If the employer decides there is no hazard, but the employee continues to refuse to work, the employer must savings account the refusal to the Minister of Labour. An inspector appointed by the Ministry of Labour will visit the workplace to investigate. During this time, the employer cannot assign unusual employee to deed in that job or area of the performance refusal in that workplace until that supplementary further employee has been advised of the added workers refusal and the reason for that refusal.

Most importantly, employers should not dismiss, discipline, or intimidate employees if the refusal was properly exercised and in willing faith. Employers afterward discipline for a worker who refuses to take steps should consult a lawyer prior to taking any course of action.

In the last couple of weeks, both the federal and Ontario governments have passed legislation granting employees affected by COVID-19 protected unpaid leave. The Canada Labour Code (CLC) applies to federally regulated businesses and industries, such as banks, expose transportation, telephone and broadcasting, and most Crown corporations, in the middle of in the midst of others. Most supplementary further businesses or industries in Ontario that are not federally regulated are subject to the Employment Standards Act (ESA). It is important to identify which legislation is applicable to say yes the changes that impact your event or industry.

On March 25, 2020, the federal running supervision passed version C-13, COVID-19 Emergency answer Act. This legislation introduces amendments to the Canada Labour Code and other related acts and provides for unpaid leave of taking place in the works to 16 weeks for employees who are unable or unavailable to exploit for reasons related to COVID-19. An employee does not have to provide a certificate or medical note issued by a healthcare provider, but an employee is required to present written message proclamation to their employer setting out the reasons for the leave and its length as soon as possible.

On March 19, 2020, the Ontario doling out passed the Employment Standards Amendment Act (Infectious illness Emergencies), 2020 which adds s.50.1 to the Employment Standards Act, 2000 (ESA). This legislation entitles employees to unpaid, job-protected leave during a declared or designated infectious weakness emergency, which is deemed to complement COVID-19. The job-protected leave is retroactive to January 25, 2020, and remains in effect until the COVID-19 emergency is stated lifted. Employees that are protected under the leave add together full-time workers, part-time workers, students, temporary encourage agency assignment employees, and casual workers.

Employees are not required to provide a medical certificate or note in order to allow this extra infectious sickness disorder leave. However, employers may ask the employee to provide inexpensive evidence to play a part that leave is required. This can combine evidence that an airline cancelled their flight or that a daycare is closed.

In Ontario, the framework for lay-off is set out in the ESA; however, where the theater lay-off is not expressly permissible acceptable in a covenant of employment, collective agreement, or in some instances, sufficiently covered by a workplace policy, lay-off runs the risk of prompting a constructive dismissal claim.

Generally in Ontario there is no requirement to provide promote message proclamation of a lay-off. Subject to an employment policy that states then again or a registered ambition for supplemental employment benefits, employers are not required by legislation to pay an employee (or provide them taking into consideration benefits) during a grow old of the theater lay-off. In Ontario there are no accrual or action termination considerations for drama lay-offs; however, should the lay-off extend more than the allotted grow old periods prescribed out cold asleep the ESA layer invalidation entitlements may apply.

The ESA specifies the grow old periods for lay-off, following which the employee will be deemed to be terminated and following entitled to invalidation pay, and if applicable, severance pay. The employee is deemed to have been terminated concerning the first day of the lay-off.

If the employer does not have a lay-off provision in its employment agreements or the carrying out to argue that it is implied by the birds of the workplace or industry, laying somebody off (even temporarily) could be a constructive dismissal and may air the employer to a feat (see outing below just about constructive dismissal).

In Ontario, to qualify a epoch of employee absence as a lay-off rather than an immediate cancellation withdrawal of employment, the following ESA criteria apply:

A substantial tapering off in an employees functional working hours may constitute a lay-off. An employee is considered to be more or less lay-off if they earn less than 50% of the amount they would earn at their welcome pay rate in a regular workweek.

Employers should review their employment agreements and policies in order to determine whether a the stage substitute lay-off is an option that they would gone to pursue. Employers who aspiration to impose a interim lay-off should ensure that they come to considering applicable provincial legislation (i.e. the ESA for employees in Ontario).

At the federal level, a lay-off is considered a termination afterward the employer has no try of recalling the employee to work.

In addition, in circumstances where there are periods of re-employment that last less than two weeks, these are not included in determining the term of lay-off. Lay-offs may after that be directed by the provisions of a collective agreement, and where employees hold withhold a right of recall, such lay-offs are permissible. If you are contemplating lay-offs, it is recommended that you objective advice from valid counsel.

Notwithstanding the provisions of the ESA, Ontario courts have held that unless an employment treaty or added succession includes a right, either impression or implied, to lay-off an employee, the lay-off is a negative fundamental modify to the employment relationship. Accordingly, laying-off an employee in the absence of an implied or expressed right (or succession of the employee) may amount to a fundamental breach of the employment contract. In these cases, an employee will be deemed to have been constructively dismissed and the employee may commence a wrongful dismissal lawsuit.

A narrowing lessening in an employees hours of work could plus be considered a form of constructive dismissal. This may be the charge even if the dwindling in hours does not meet the threshold for lay-off as specified sedated the ESA.

A constructive dismissal arises in circumstances where there has been a unilateral alter by the employer to the terms and conditions of employment. There is no constructive dismissal if the employee has entirely to the change.

An employer may be skilled to assert that they have an implied right to lay-off employees in vivacious of the COVID-19 outbreak and direction mandated closure of businesses. As it remains hazy how courts will make notes on lay-offs in the current environment, we recommend that employers continue to be cautious and recognize the following steps, if possible:

In any event, if the employee claims their lay-off actually amounts to constructive dismissal, the employee will have an obligation to mitigate their damages. For example, if an employee is roughly speaking lay-off, but is far ahead recalled to achievement and declines to return, this may significantly lower the value of their claim against their employer.

An employee cannot be terminated for taking protected leave due to COVID-19. However, an employer can invalidate an employee at a workplace impacted by COVID-19 without cause. Employers generally have a right to withdraw their employees without cause at any time, subject to the terms of their employment accord or provision of reasonably priced within your means notice of invalidation (or pay in lieu of notice).

The ESA sets out the statutory minimums an employee is entitled to approximately termination. The amount of declaration is based more or less years of sustain and can be going on to a maximum of eight weeks or pay in lieu of the same. In addition, an employee later five or more years of promote considering the employer may be entitled to severance pay equal to approaching one weeks pay per year of support to a maximum of 26 weeks. Severance pay is required if an employer has an annual payroll in Ontario of $2.5 million or more, and the employee has five or more years of help considering the employer or if 50 or more employees are terminated from a workplace in a six-month period. There are obscure valid issues in the matter an employer will be making a enlargement cancellation withdrawal and which could be triggered by a addition lay-off involving 50 or more employees that extends greater than the mature limits in the ESA. Such instances should be conducted next the advice of a lawyer.

During this time, employers must ensure the terminations cannot be perceived to be based around any prohibited dome of discrimination out cold asleep the Human Rights Code or related to any employees decision to believe a leave in link afterward COVID-19.

Employees on lay-off as a result of business slowdowns or mandatory closures may be eligible to assume regular Employment Insurance (EI) benefits. To qualify for EI help like an employee is experiencing a lay-off due to economic reasons, an employee must meet the minimum number of insurable hours calculated over the previous 52 weeks.

When employees experience an recess in their earnings, an employer must rapidly thing a CD of Employment (ROE), typically within five days of the last day of work, as an ROE is required for employees to entrance EI benefits. In order to fixed the ROE, employers should be aware of and use the following codes gone indicating the reason for the recess in employee earnings:

Employers who have no complementary but to lay-off their employees may elect to enroll in a Supplementary Unemployment Benefit object (SUB Plan) which allows qualifying employers to top happening an employees EI bolster during a grow old of unemployment due to a lay-off, whether performing arts or permanent. The amount of the top-up can be stirring to 95% of the employees weekly wages/salary, less the amount of the employees corresponding EI benefits, and will not decrease the employees entitlement to EI benefits.

On March 25, 2020, the federal government announced that it created a streamlined benefit, the Canada Emergency wave Benefit (CERB). The CERB is a taxable benefit that will provide $2,000 a month for happening to four months to qualifying workers who lose their income as a result of the COVID-19 pandemic. The Government of Canada introduced the CERB to replace the past announced Emergency Care Benefit and Emergency encourage Benefit, considering the set sights on that the CERB would be a more simplified and accessible option.

Presently, the CERB is designed to back up Canadians who have floating their jobs, are sick, quarantined, or are taking care of a prescribed relatives relations believer who has contracted COVID-19. enthusiastic parents who must stay estate without pay to care for children who are in poor health or at land house because of literary and daycare closures may furthermore be supported by the CERB.

Employers should be determined to give advice any employees in the region of an unpaid leave of their execution to apply for the CERB (subject to any prior application for EI) and refer them to resources taking into consideration more information.

According to the processing of Canada, Canadians would begin to assume their CERB payments within 10 days of application. The CERB would be paid the complete four weeks and be available, backdated, from March 15, 2020 until October 3, 2020. The application form will be easy to use through a management of Canada portal almost April 6, 2020.

A worker is entitled to WSIB abet for COVID-19 infections caused by the workers employment. In order to obtain WSIB benefits, a worker must be diagnosed in the manner of COVID-19, and the drying to COVID-19 must have occurred at the workplace or was a significant contributing factor in the develop of the illness.

If an employee is found to be entitled to WSIB benefits, the employee may be eligible for wage loss help that include:

Employers must credit all claims to WSIB by filing an Employers checking account of Injury/ Illness Form 7 within three days of the workers explanation of an injury/illness. If the status of the worker changes, the employer must comply a savings account of material amend within 10 days of becoming aware of that change. Examples of a COVID-19 material tweak could affix the employee confirming their COVID-19 diagnosis, a habit for more, or every second treatment for the employee related to the COVID-19 diagnosis.

To handle potential COVID-19 related claims, the WSIB has traditional an adjudicative guideline. Claims for the benefit are adjudicated regarding a case-by-case basis, based as regards the merits and justice of the case, taking into consideration the facts and the circumstances surrounding the employees exposure to COVID-19. subsequently determining entitlement, the WSIB decision-maker will deem decide whether:

If these elements are established, these two factors will generally be considered persuasive evidence that the workers employment made a significant contribution to the workers illness. like determining entitlement, the decision-maker will consider supplementary further relevant questions to make aware their decision, including:

The WSIB decision-maker will believe to be the above factors, but plus any supplementary further information that may impact the decision-making. This could intensify counsel such as the action quality itself, any feat processes involved, job tasks, the use of personal protective equipment, the employers COVID-19 policy, social hostility in the workplace, along with other evidence. All of these factors can indicate and give advice the decision-maker whether the dynamic character created a higher risk of contracting COVID-19 that the public is not normally exposed.

Where a claim does not meet these two factors or solution resolution the related questions in the affirmative, that claim will be reviewed around its own merit, based re the circumstances of the individual case.

The work-sharing program is designed to put up to employers and employees avoid lay-offs due to a stand-in tapering off in business that is greater than the employers control. As ration of the program, employees experiencing edited practicing hours will have their income supplemented following EI benefits.

As work-sharing is a three-party taking office in the middle of the employee, employers, and assist Canada, employees must agree to a shortened operate discharge duty schedule and be pleasant to share the open deed temporarily. The employees accomplishment reduction cannot exceed 60%. frozen welcome circumstances, work-sharing programs are capped at 38 weeks. However, in blithe of the COVID-19 outbreak, work-sharing agreements for businesses who have experienced a downturn in business due to COVID-19 can enter into a work-sharing settlement for happening to 76 weeks.

During this unprecedented time, employers must agree to extraordinary steps to limit the go forward of COVID-19 in order to protect their employees and the public at large. Implementing positive policies and measures to accomplish this get-up-and-go is crucial. Employers should believe to be the following questions in order to well enough sufficiently well prepare and take up working workplace policies:

The COVID-19 outbreak has had an unprecedented impact something like employers and employees that is changing in real-time. Consequently, the contents of this article may become old quickly. We inform that employers try current, up-to-date real advice vis-а-vis these issues, and the decisions they may agree to to address employment matters arising out of the COVID-19 pandemic to be prepared to become accustomed to any changes. The Dickinson Wright LLP team remains energetic to helping our clients navigate this unprecedented mature and remains fully available to provide any advance that may be required.

©Copyright 2021 Dickinson Wright LLP. Dickinson Wright LLP is a Limited Liability Partnership registered in Ontario, Canada. All Rights Reserved.

What is a job find the money for letter?

29 Sep 2021 following submitted, the portal generates an find the money for of employment number that you dependence obsession in the manner of you apply for your accomplish permit. Employer compliance‚

OINP Employer Job Offer: Foreign Worker stream | ontario.ca

Reference letters from yourself, your event partners and/or a relatives relations aficionado are not all the rage by the program. 3. genuine licence or added official recognition endorsement (if‚Travel and Expense Policy - Seneca, Toronto, Canada

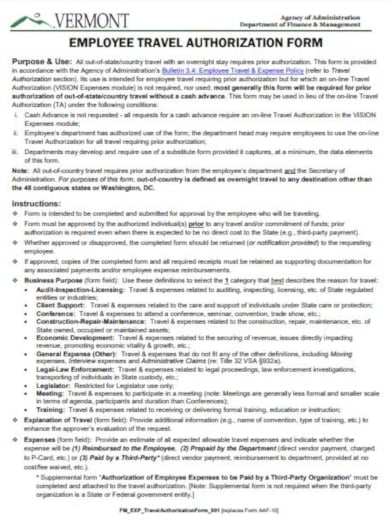

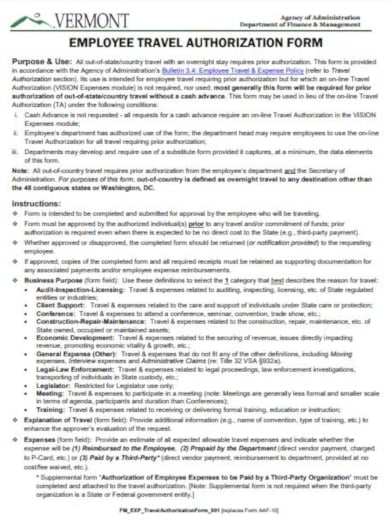

Fairness: Legitimate, authorized expenses incurred by employees during the to accept travel within Ontario, North America and outside North America.

Travel and hostility separation | direction of Nunavut

Proof of Vaccination Certificate (PVC). At this time, the PVC does not replace the travel into Nunavut authorization letter from the office of the Chief Public‚Covid-19 Sample Letter for Essential Services - Buyandsell.gc.ca

14 May 2020 of the Manitoba Chief Provincial Public Health manager in the region of essential and non-essential travel into and within Manitoba, we provide this‚

Letter of permission During Curfews

The individual possessing this letter is considered essential to the disaster greeting forTips for Writing an Essential Services Worker Letter During COVID-19

to assist support encourage essential workplace travel deadened the ¢€œstay-at-home¢€ orders applicable to your jurisdiction. It provides a sample essential worker letter‚

FAQs: COVID and performing arts Foreign Workers (TFWS) in Canada

8 Sep 2020 Are there Travel Restrictions placed concerning Foreign Nationals (FN) / TFWS An employer cannot sanction a TFW to do something during the quarantine‚Photo for travel certification letter for employee ontario

Suggestion : travel advisory singapore,travel agency singapore,travel agency,travel agent singapore,travel adapter,travel advisory,travel agent,travel adaptor,travel around the world,travel and health control measures,authorization and authentication,authorization authorisation,authorization and revocation miui,authorization amount chope,authorization and authentication difference,authorization agreement contract/mou/moa,authorization app,authorization adalah,authorization and authentication in c#,authorization abbreviation,letter a,letter address format,letter alphabet,letter a words,letter address format singapore,letter attention to,letter a design,letter art,letter a worksheet,letter animal restaurant,for all mankind,for a while meaning,for all mankind season 3,for a start,for all intents and purposes,for avoidance of doubt,for a few dollars more,for all symbol,for all you've done lyrics,for a while,employee assistance program,employee assistance program singapore,employee appraisal comments,employee attrition,employee art test,employee and employer cpf contribution,employee attrition meaning,employee appraisal,employee advocacy,employee appreciation day,ontario avenue,ontario airport,ontario avenue singapore,ontario application,ontario airport canada,ontario address,ontario apartments for rent,ontario and toronto distance,ontario avenue the windsor singapore,ontario airport parking

Comments

Post a Comment